However, despite their reputation, accessing these organizations has

traditionally been challenging for non-institutional investors globally.

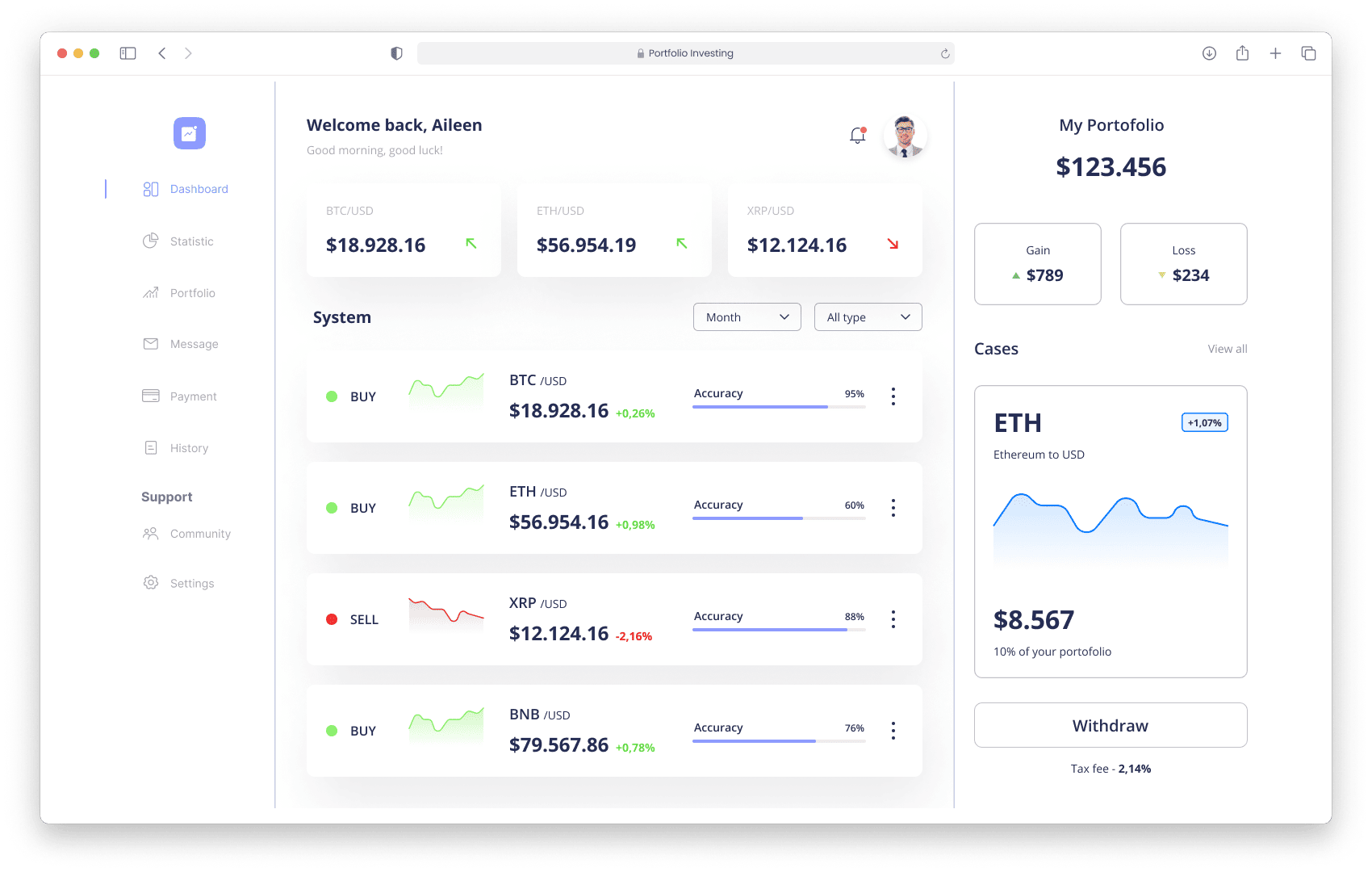

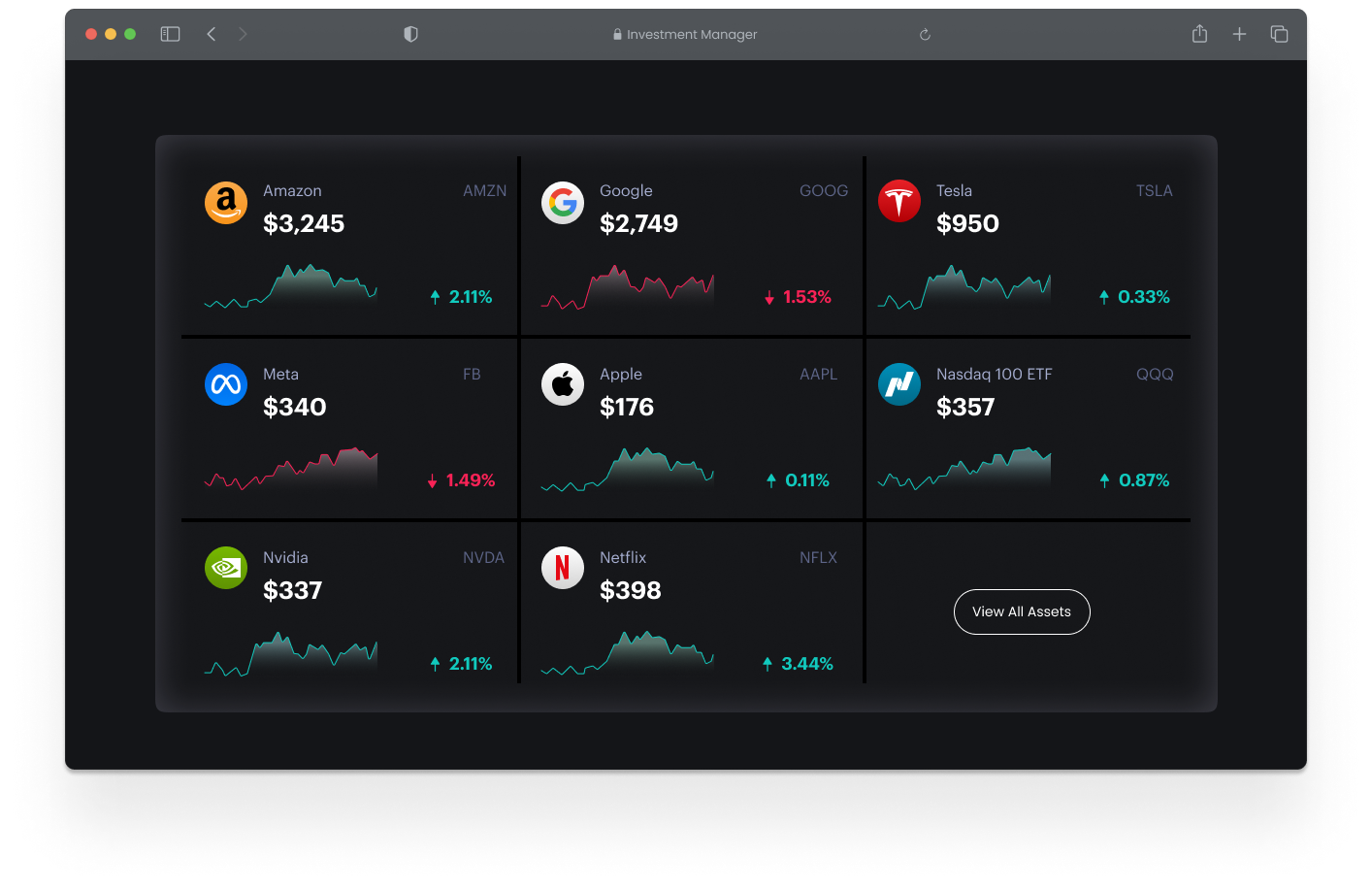

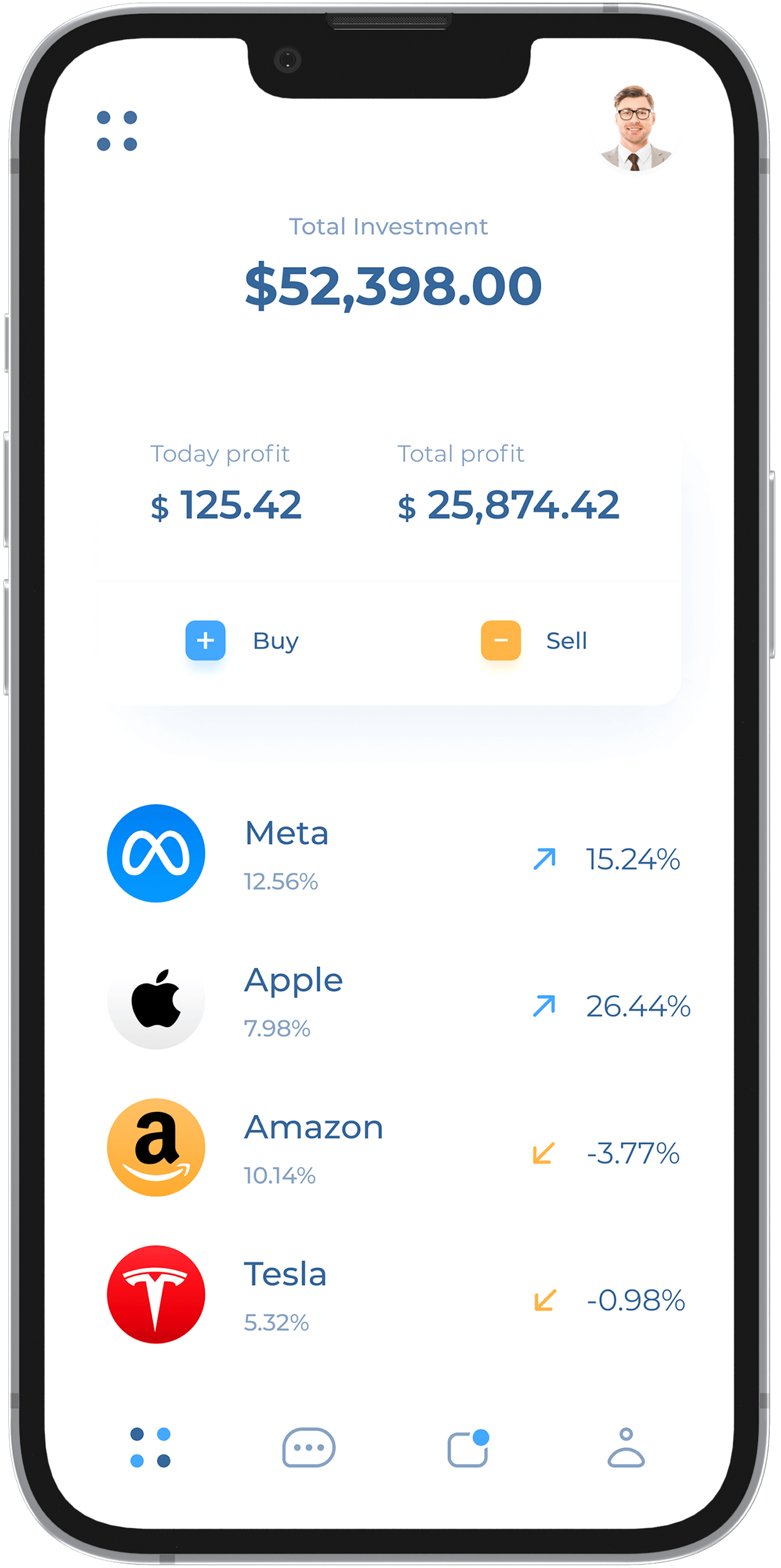

Cethra aims to break this barrier by providing a direct link,

accessible through mobile devices, to the highest quality funds worldwide, making them available

to all investors.

It's important to note that not all funds managed by

world-leading asset managers automatically qualify as "top-tier."

Prior to establishing a compliant feeder into a fund,

we rigorously conduct due diligence to ensure it meets

our strict criteria for listing on our portal. Cethra follows a stringent

fund selection process to exclusively offer top-tier funds.

This approach is designed to ensure guaranteed profitability for all our investors.