Services

Our Services

Stocks

You can own pieces of companies through stocks, giving your portfolio the chance to gain value over time.

ETFs

New investor? Seasoned pro? Either way, our robust lineup of active and passive exchange-traded funds, research tools, and expertise can help make it easier to find the right ETFs for you.

Crypto

Cryptocurrency is a digital form of currency that's transferred peer-to-peer through the internet.

Bonds

Individual bonds, including corporate, municipal and government bonds, can help to provide principal preservation, regular income, and potential tax benefits.

Futures

These contracts are standardized and traded on organized exchanges, facilitating speculation and hedging in various financial markets.

Real Estate

Investing in real estate involves purchasing, owning, managing, renting, or selling property for financial gain.

Vision - Home to Traders

We represent an ecosystem that champions equal opportunity for all traders, where outcomes are solely determined by merit.

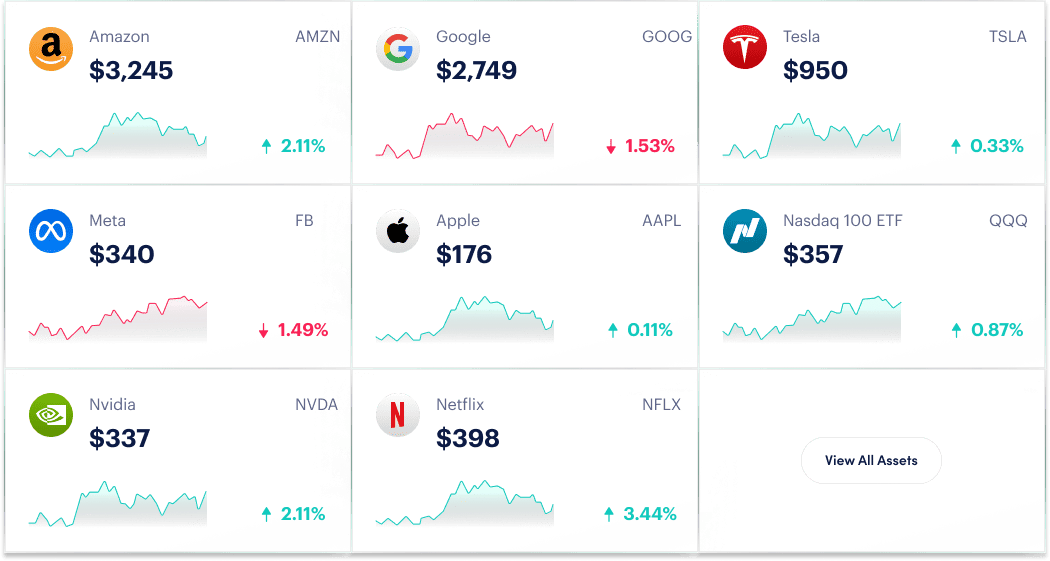

Stocks

You can own pieces of companies through stocks, giving your portfolio the chance to gain value over time. When you buy a stock, you own a piece of the company that issues it. There are several ways of classifying companies and their stocks. If you buy a company’s stock, you become a part owner and you’ll generally make money if the company does well—or lose money if it doesn’t. Depending on how established the company is, most of the money you make will come either through increases in share price or through dividend payments. Larger companies tend to be more stable than smaller companies, but they also have less room for growth.

Why buy stocks?

When people talk about investing in stocks, they’re usually referring to common stock.

These kinds of stocks give you the opportunity to join in the success of public companies, and as such, they’re an investment that can really grow your portfolio.

Because you’re a part owner of the company that issues your stock, it’s pretty simple: For the most part, when the company makes money, you make money. (Conversely, of course, when the company loses money … well, you get the picture.)

There are a couple of ways you’ll see this part-ownership reflected.

First, the price of each share of stock can increase in value. If you buy 50 shares at $10 a share and then the share price increases to $15, you’re now $250 richer.

The company can also choose to issue a dividend to shareholders. Say the issuer of your 50 shares of stock announces a $2 dividend. That means you’ll be paid $100 (which you can use to buy more shares, if you wish)

GROWTH STOCKS

TOP STOCKS

VALUE STOCKS

TOP STOCKS

TECH STOCKS

STOCK LOSE

Investing in ETFs

New investor? Seasoned pro? Either way, our robust lineup of active and passive exchange-traded funds, research tools, and expertise can help make it easier to find the right ETFs for you.

Enhanced Large Cap Core ETF

A U.S. equity strategy maintaining a large-cap core profile, leveraging a disciplined approach investing in companies with attractive characteristics.

Total Bond ETF

Seeks a high level of current income, using a set of global fixed income securities to help add value in different markets.

iShares Core S&P 500 ETF

The investment seeks to track the investment results of the S&P 500 composed of large-capitalization US equities.

Wise Origin® Bitcoin Fund

What makes our mission worthwhile is that we breathe by these values, every step of the way.

Cryptocurrency

What is crypto?

Cryptocurrency is a digital form of currency that's transferred peer-to-peer through the internet. Fidelity is here to help you gain access to assets like bitcoin, the first and largest asset in the growing category, with expertise in security and reliable support.Explore the growing number of opportunities to trade and invest in the emerging cryptocurrency universe

Find the right fit>

Enter the new frontier of crypto through a choice of offerings to suit your needs.

Train your brain

Our focus on education will help you trade crypto with clarity.

Get an edge

Trust is built over years of experience. Since 2014, we've been an innovator in crypto.

Fixed income, bonds, and CDs

Whether you're looking for income, diversification, tax efficiencies, or protection from stock market volatility, bonds, CDs, and other fixed income investments can play an important role in any portfolio.

Choice:

Access to a wide range of fixed income investment options, including, FDIC-insured CDs,1 bond funds, over 100,000 individual bonds, and professionally managed bond portfolios.

Value:

Low, transparent fees of just $1 per online bond trade, which could save you up to $15 per bond,2 plus free online trading for US treasuries and CDs.3

Support:

You'll have access to our specialists in fixed income and, for eligible clients who meet certain investment minimums, our high net worth desk who can help you integrate bonds and CDs into your portfolio.

How do you like to invest?

If you're looking to build your own fixed income portfolio, we offer an extensive selection of individual bonds, CDs, and annuities.

Invest in Bonds

Individual bonds, including corporate, municipal and government bonds, can help to provide principal preservation, regular income, and potential tax benefits.

Certificates of deposit

Brokered CDs can offer FDIC-insured1 principal protection from a variety of different banks. Fractional CDs NEW Minimum investment and increments of $100.

Deferred fixed annuities

These annuities offer a competitive guaranteed5 rate of return over a set time period, as well the tax benefits of deferred income.

Our Partners